A Study on The Impact of GST on Indian Economy

Main Article Content

Abstract

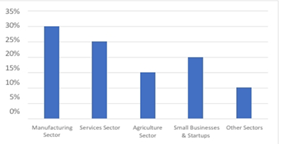

The Goods and Services Tax (GST) was implemented in India on July 1, 2017, as a transformative tax reform designed to unify the nation’s indirect tax system. It replaced multiple indirect taxes, including Value Added Tax (VAT), excise duty, and service tax, with a streamlined structure to enhance tax compliance, reduce tax evasion, and simplify business operations. GST operates on a multi-tier system, allowing for better tax administration, the elimination of the cascading tax effect, and improved revenue collection. This study examines the impact of GST on the Indian economy, focusing on its effects on tax compliance, economic growth, inflation, and various business sectors. The introduction of GST has led to greater transparency, increased government revenue, and a more structured taxation framework. Businesses, particularly in manufacturing and logistics, have benefited from reduced operational costs and simplified processes. However, small and medium enterprises (SMEs) have faced challenges due to compliance burdens, frequent changes in tax rates, and technical difficulties in the GST Network (GSTN). The research highlights both the positive outcomes and the difficulties associated with GST implementation. While it has enhanced ease of doing business, reduced tax evasion, and broadened the tax base, initial disruptions and sector-specific challenges have created hurdles. The study also discusses policy recommendations such as simplifying tax structures, improving digital infrastructure, and providing better support for small businesses to maximize the benefits of GST.GST is a significant step toward economic reform in India. With continuous improvements and policy refinements, it has the potential to further strengthen economic stability, improve business efficiency, and support long-term growth. This research underscores the importance of ongoing adjustments to ensure GST functions optimally and benefits all sectors of the economy.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.