Assessing the Long-Term Implications of CBDCs for Global Financial Stability, Reserve Currency Dynamics, and the Future of Dollar Dominance

Main Article Content

Abstract

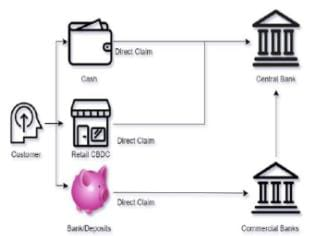

The emergence of Central Bank Digital Currencies (CBDCs) has become a prominent subject of worldwide discourse, especially in emerging nations where financial inclusion, monetary sovereignty, and banking stability are essential issues. This study examines the possible effects of CBDC implementation on the profitability and stability of commercial banking systems in these economies. This study employs a qualitative methodology via a literature evaluation of Central Bank Digital Currency (CBDC) implementations in significant rising economies, namely China, Nigeria, Brazil, Russia, and India. The research indicates that although CBDCs can improve efficiency and financial accessibility, their effects differ based on a nation's banking infrastructure, regulatory environment, and financial stability protocols. In certain instances, CBDCs have intensified liquidity issues for commercial banks, whilst in others, they have fostered digital innovation and other revenue sources. The results underscore the necessity for strategic cooperation between central banks and commercial financial entities to alleviate risks while capitalizing on the advantages of CBDCs. Policy considerations encompass establishing restrictions on CBDC holdings, integrating CBDCs with current banking services, and promoting regulatory frameworks that facilitate a balanced financial environment. This study enhances the scholarly discussion on digital currencies and banking by providing insights into the changing roles of central banks and commercial banks within the digital financial ecosystem.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.