API Augmented Reinforcement Learning Framework Utilizing LLMs for Enhanced News-Based Stock Portfolio Strategies

Main Article Content

Abstract

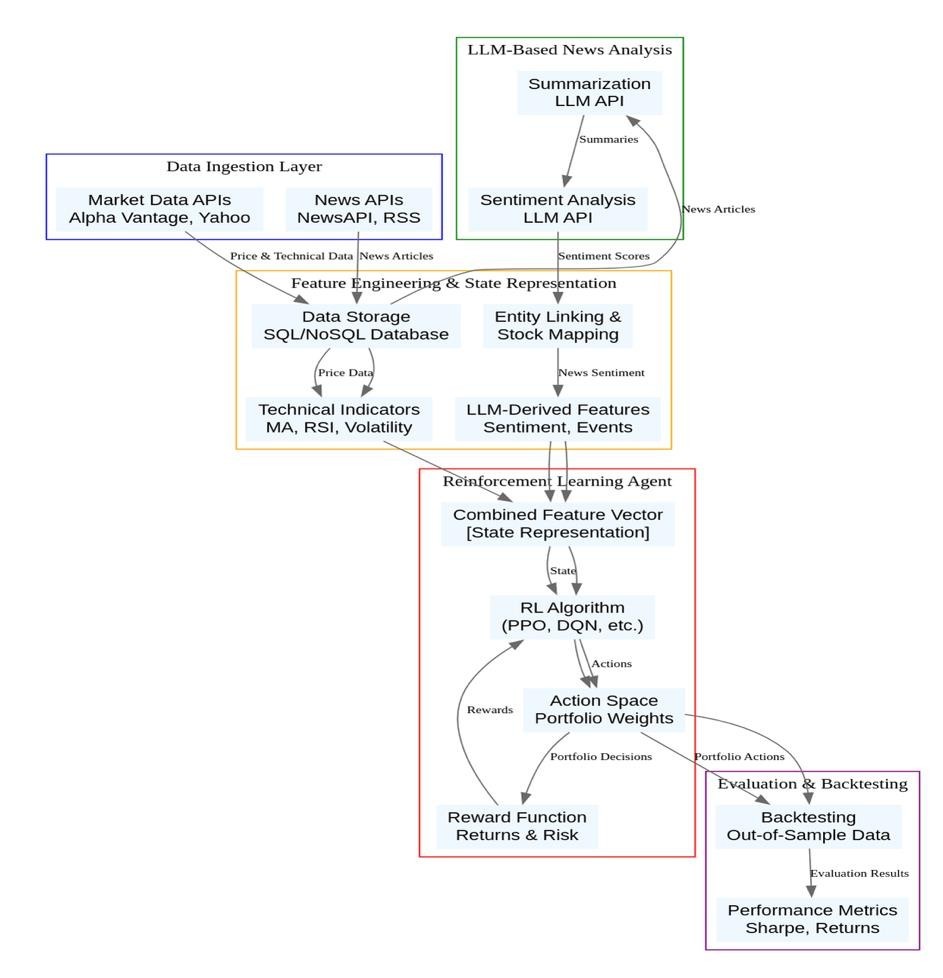

This paper introduces an API Augmented Reinforcement Learning (RL) framework that utilizes Large Language Models (LLMs) to enhance stock portfolio strategies by leveraging real-time news data. Traditional financial strategies primarily focus on historical and technical indicators; however, our approach integrates sentiment analysis and summarization of news articles to influence reinforcement learning agents’ decision- making. News-based features, combined with market indicators, form a comprehensive state representation for training RL algorithms such as Proximal Policy Optimization (PPO). This hybrid system optimizes stock allocation dynamically, offering enhanced portfolio performance when evaluated against benchmark strategies.