Reinforcement Learning for personal finance management

Main Article Content

Abstract

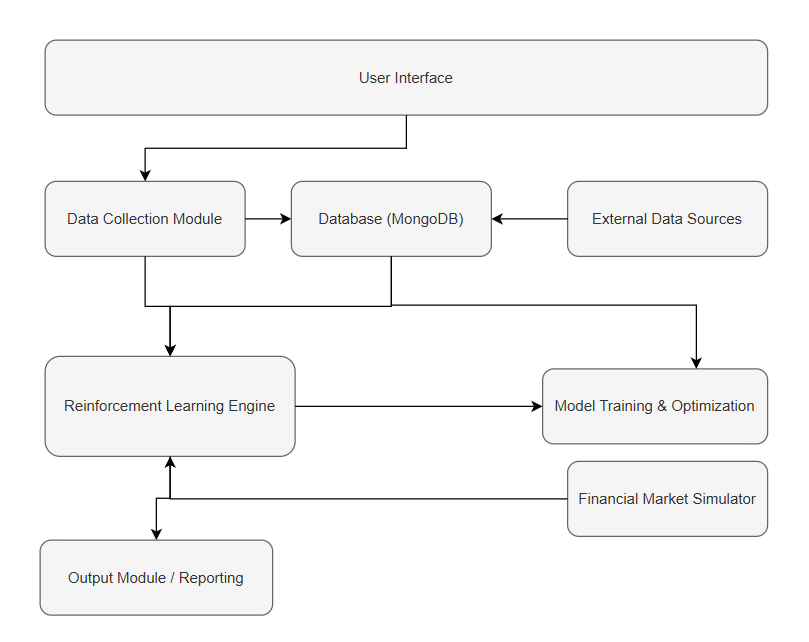

This paper proposes an innovative AI-driven personal finance management system that leverages advanced reinforcement learning techniques to deliver adaptive financial strategies. By modeling the finance problem as a Markov Decision Process and employing Deep Q-Learning, Actor-Critic, and Proximal Policy Optimization, the system continuously learns from historical and real-time data. Developed using Python and TensorFlow, with MongoDB for data storage, the system integrates a financial market simulator to refine decision-making under realistic conditions. The result is a dynamic platform that optimizes budgeting, saving, investing, and debt management while balancing risk and reward. Preliminary evaluations indicate enhanced risk-adjusted returns and improved decision efficiency, paving the way for a more responsive, personalized approach to financial management.