Exploring the Role of Reinforcement Learning in Personal Finance Management: A Comprehensive Literature Survey

Main Article Content

Abstract

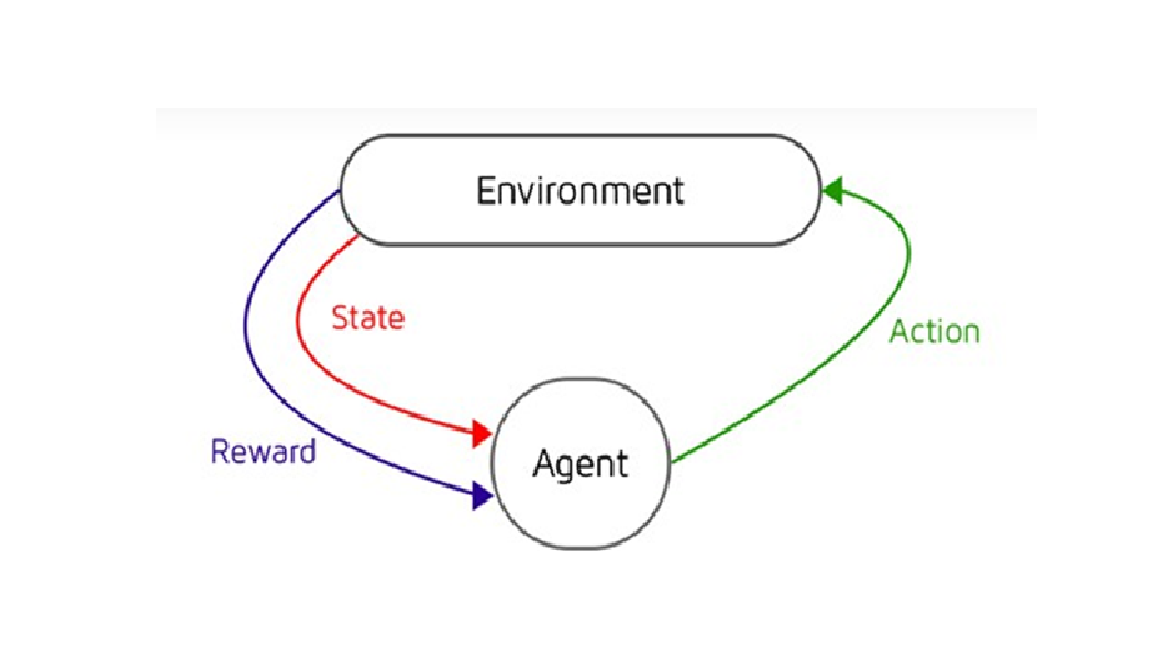

Reinforcement Learning (RL), a dynamic branch of machine learning, has emerged as a powerful tool for addressing complex decision-making challenges by learning through interactions with ever-changing environments. In the realm of personal finance management, RL offers innovative approaches to optimize various financial tasks, such as budget allocation, investment strategies, debt management, and savings optimization. This survey explores the application of RL techniques in personal finance, focusing on widely used algorithms like Q-learning, Deep Q-Networks (DQN), and policy gradient methods. It examines their role in enhancing financial decision-making and addresses the challenges associated with their implementation, including managing sparse and noisy data, ensuring model interpretability, and tackling ethical concerns. The integration of RL with complementary technologies, such as financial forecasting tools and portfolio optimization systems, is also reviewed. By analyzing current research, this study highlights the transformative potential of RL in empowering individuals to make informed financial decisions and achieve sustainable financial well-being. It also identifies existing gaps and provides future research directions to develop robust, scalable, and user-centric RL solutions in personal finance management.

Downloads

Article Details

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.