Predicting Customer Churn In Banking Sector

Main Article Content

Abstract

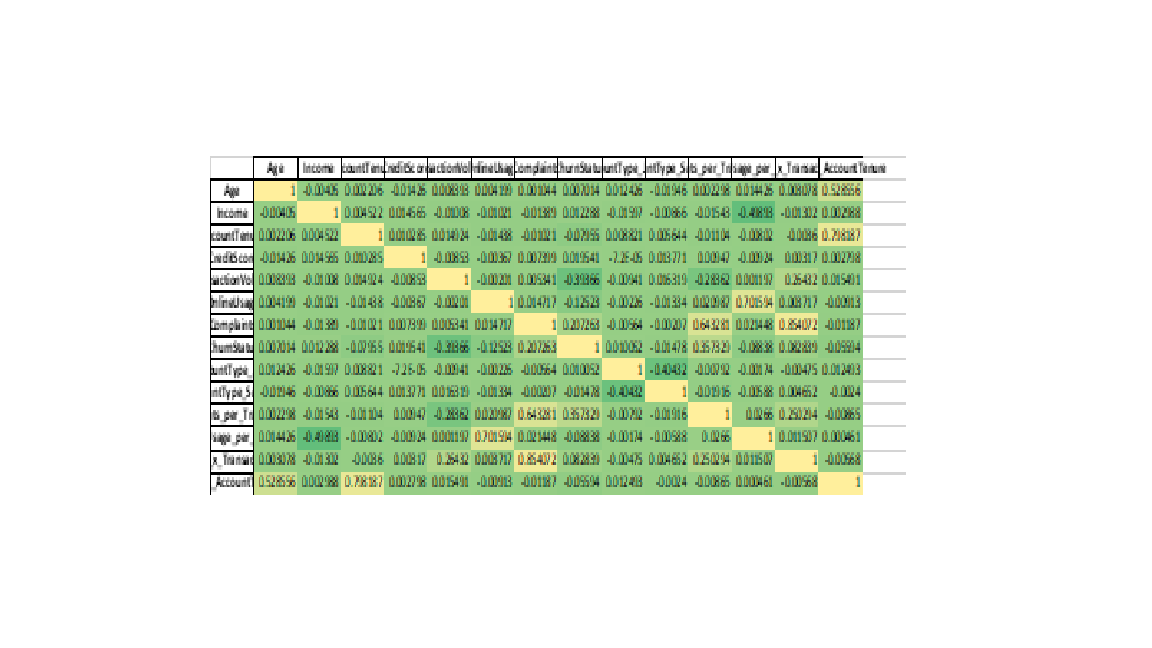

Customer churn in banking is one of the significant issues, as retaining a customer is costlier compared to acquiring new customers. Thus, this paper would try to discuss the development and application of predictive models that could be used in identifying churners through machine learning techniques. Historical banking data, comprising transaction history, customer demographics, and behavioral patterns, are utilized for the building of a strong framework to predict churn in this research. Methodology includes data preprocessing, feature selection, and multiple classification algorithms, such as logistic regression, support vector machines, and ensemble models, with an evaluation process. Results show substantial improvement in accuracy compared to churn prediction and emphasize the most influencing factors for retention of customers. This work has given banking institutions actionable knowledge to facilitate proactive measures to enhance customer experience and minimize churn. The approach thus proposed brings forth its scalability and applicability in every banking context and paves the way for better decision-making in customer relationships.