Optimizing Banking Decisions through Documentation-Aided Machine Learning Architectures

Main Article Content

Abstract

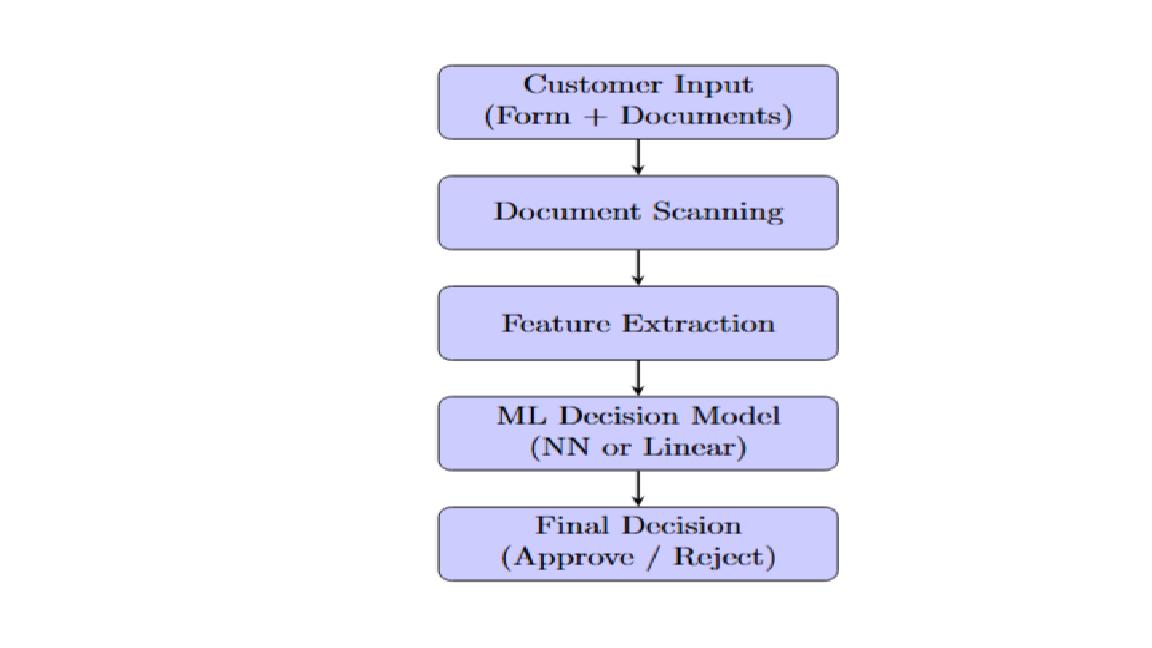

In the evolving landscape of the banking industry, ensuring secure, efficient, and transparent decision-making mechanisms is crucial. This study presents an approach that integrates documentation and identification layers with machine learning (ML) models, particularly artificial neural networks (ANN) and convolutional neural networks (CNN), to enhance decision-making processes in financial sectors. With increasing cases of fraud, inefficiencies in credit evaluation, and challenges in real-time documentation verification, machine learning offers a robust solution by learning from vast datasets and providing predictive insights. The paper explores the application of ML in analyzing client behavior, predicting creditworthiness, and automating loan approvals, while also highlighting the role of identification documents and structured input data in training the models. By merging traditional documentation processes with advanced ML frameworks, we propose an architecture that improves transparency, reduces bias, and aligns with global banking regulations. Experimental evaluations indicate improved accuracy and adaptability in loan processing scenarios. The proposed approach contributes to building more intelligent, inclusive, and secure banking environments.