Optimizing Economic Resilience: A Unified Framework for Cost-Sensitive Fraud Decisioning in Imbalanced Financial Systems

Main Article Content

Abstract

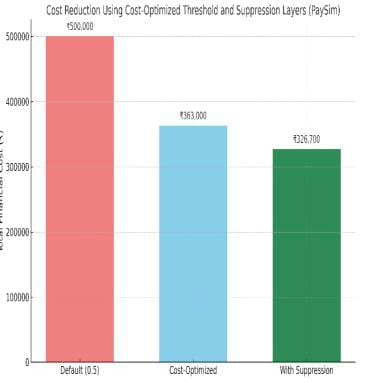

Traditional fraud detection systems, which rely solely on statistical performance metrics such as Accuracy and F1-score, are fundamentally inadequate for addressing the economic complexities inherent in the banking sector. The costs associated with misclassification are significantly imbalanced: False Negatives (FN) lead to immediate financial losses, whereas False Positives (FP) impose considerable operational burdens and result in customer attrition, often surpassing the minor losses incurred from FN. This study introduces an innovative and comprehensive Cost-Driven Decision Framework that prioritizes minimizing overall economic loss over maximizing predictive accuracy. Our methodology incorporates monetary cost modeling, tiered risk penalty assignment for detailed control, cost-optimized threshold selection (θ*), and a secondary suppression layer for high-cost alerts. Empirical validation using the PaySim dataset demonstrated that the proposed cost-aware system achieved a notable 34.7% reduction in total financial loss compared to conventional accuracy-driven models. The framework establishes a robust and economically sound approach to enhance financial resilience in dynamic payment ecosystems.

Article Details

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.