Design and Development of Stock Market Prediction for Optimization of Retirement Funds

Main Article Content

Abstract

-

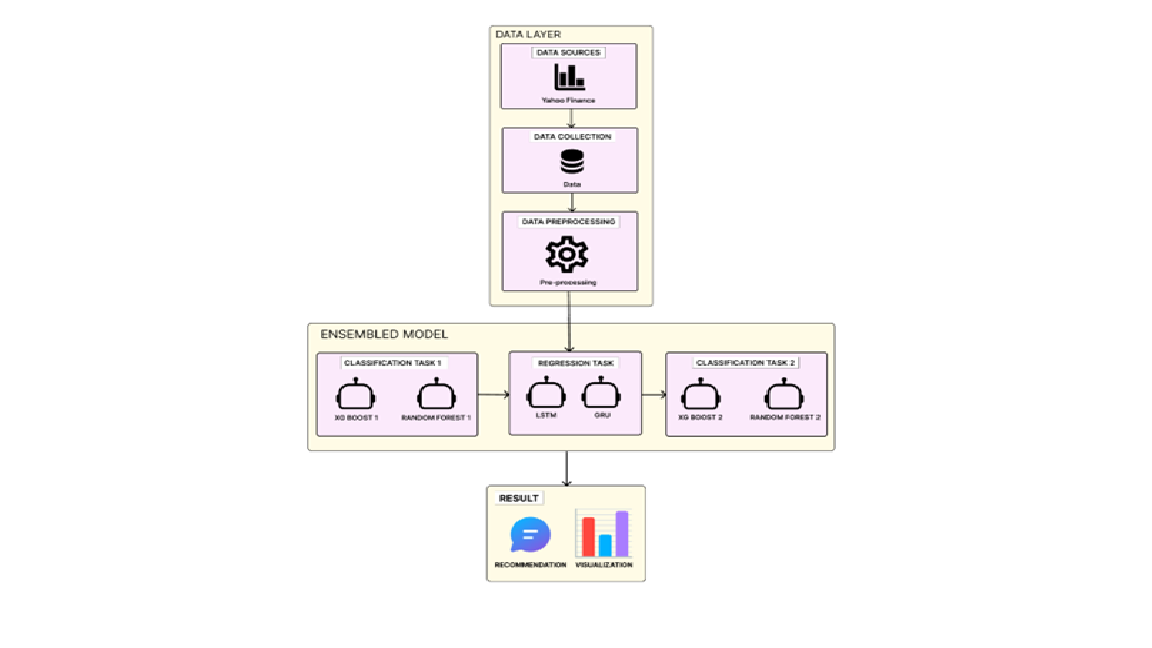

Even after extensive research, it is difficult to make accurate and trustworthy stock market predictions for retirement portfolios. Automated investment systems today include tax-loss harvesting capabilities but lack advanced prediction models. An ensemble learning framework incorporates LSTM and GRU along with Random Forest and XGBoost systems in order to improve prediction outcomes and decision processes. Market Capitalization, P/E Ratio, P/B Ratio, Net Profit and EPS receive XGBoost and Random Forest analysis to establish trends while minimizing errors. The stock recommendation procedure utilizes time-series inputs from LSTM and GRU that analyze historical input data containing technical indicators such as Closing Price, SMA, EMA, MACD, RSI, Bollinger Bands, and Volume. The unified recommendation system creates final outputs through an aggregation method using all model outputs. For stock identification the evaluation procedure conducts labeling on high-performing stocks that form 30% of the total stocks and trains models to find them before final selections proceed through combined XGBoost and Random Forest scores for optimal investment choices. Backtesting against the NIFTY50 index proved the potential use of the system as a long-term financial security strategy.