Comprehensive Literature Survey on Predictive Analytics in Financial Market Forecasting: Techniques, Trends, and Applications

Main Article Content

Abstract

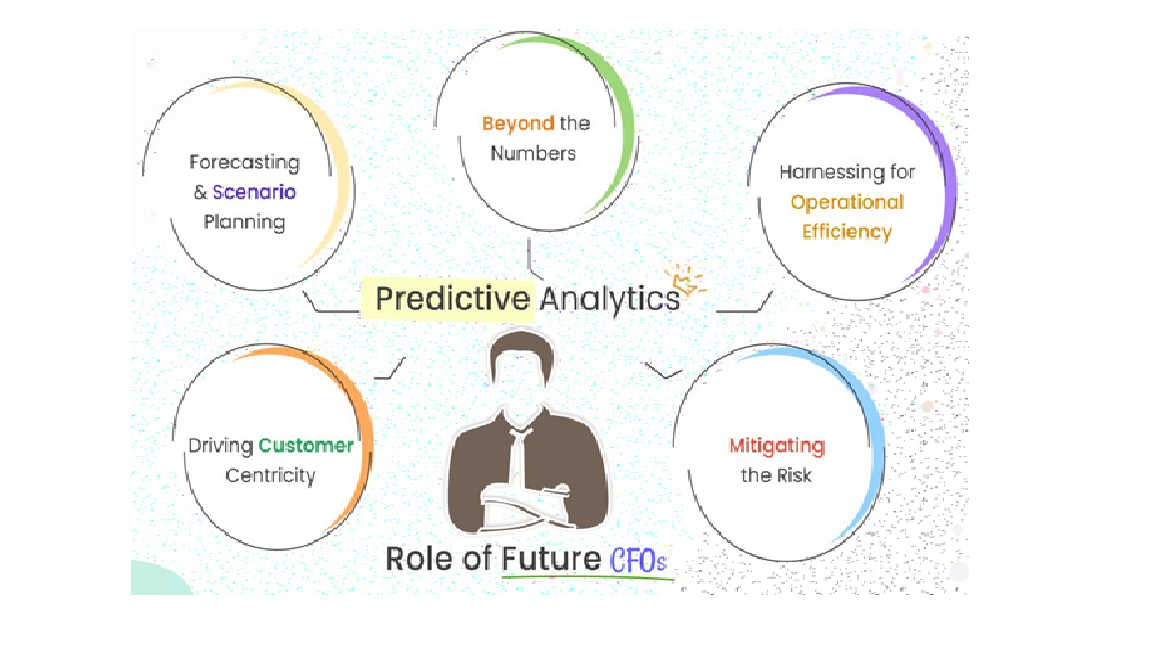

Predictive analytics has become a critical tool in financial market forecasting, leveraging advanced statistical and machine learning techniques to predict market trends and make informed investment decisions. This comprehensive literature survey explores the various predictive analytics methodologies used in financial market forecasting, including time series analysis, machine learning algorithms, and deep learning models. The paper reviews key techniques such as regression analysis, support vector machines (SVM), neural networks, and ensemble methods, and assesses their effectiveness in predicting stock prices, market volatility, and other financial metrics. It also highlights emerging trends in the field, such as the integration of big data, sentiment analysis, and alternative data sources, and the growing role of artificial intelligence (AI) in market prediction. The paper discusses the challenges and limitations of predictive analytics in financial markets, such as data quality issues, model interpretability, and overfitting, and suggests future research directions to improve prediction accuracy. Overall, this survey provides valuable insights into the state-of-the-art techniques and applications of predictive analytics in financial market forecasting, offering a foundation for researchers and practitioners to develop more robust and accurate models.